Help your loan officers act on data insights instead of gut instincts

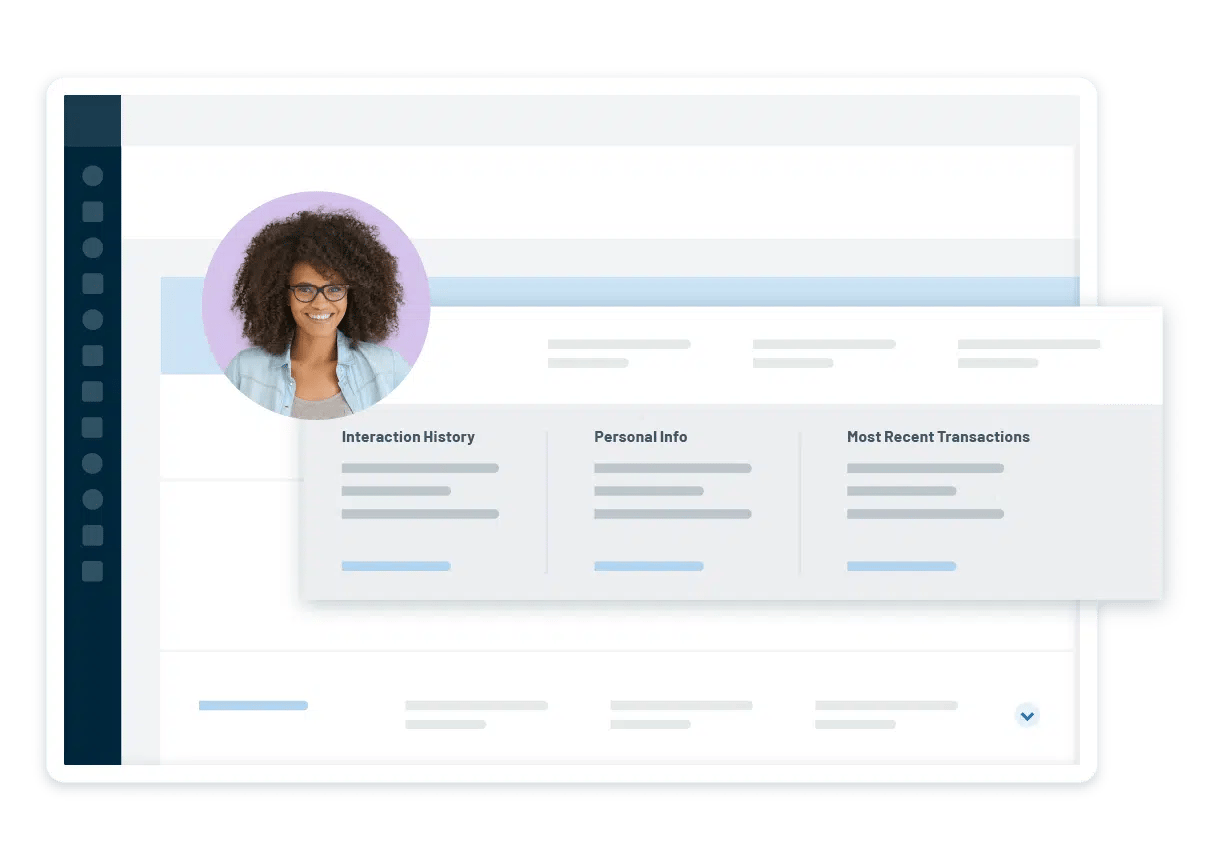

Total Expert Customer Intelligence supercharges lead generation to better serve your customers at every financial milestone. By continuously enriching your customer records with data on the equity they have in their home, Customer Intelligence is able to surface opportunities that would otherwise slip through the cracks. Now, loan officers can easily identify, segment, and engage equity-rich customers with the products and services that are most relevant to their needs—delivering a seamless, personalized customer experience with every interaction.